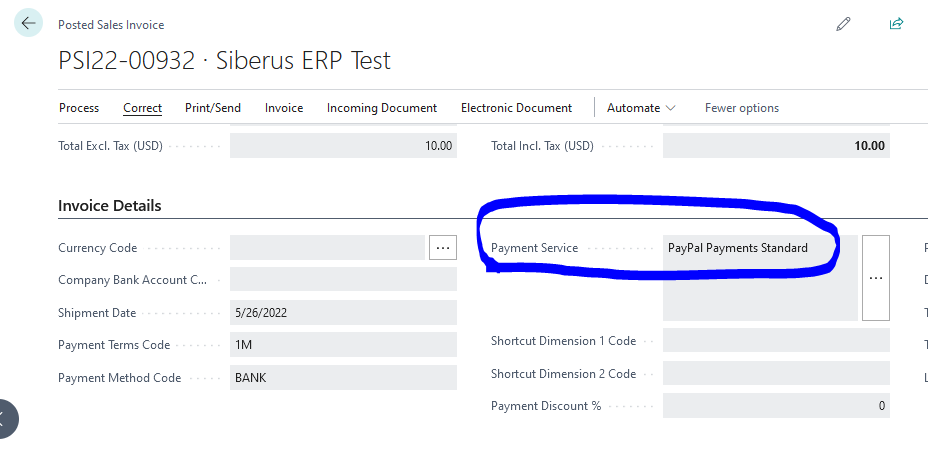

Business Central has in-built PayPal extension. You can choose it as a payment service in a sales order:

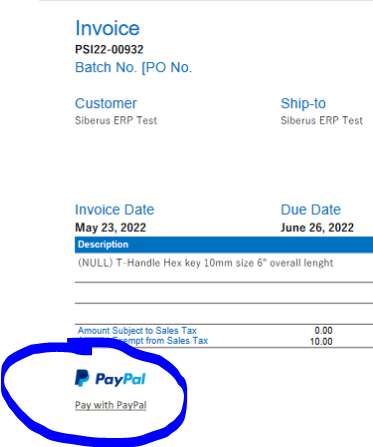

It generates PayPal payment link in posted sales invoice printing form:

Business Central uses a separate app for this functionality - Payment Links to PayPal by Microsoft:

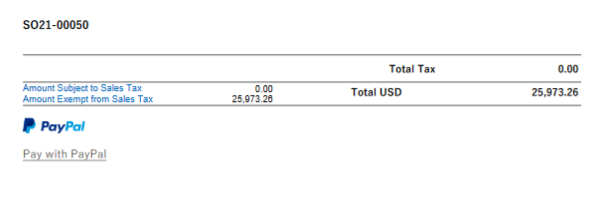

We worked with this app closely as a dependent app, because one of our customers asked us to expand this functionality. Standard functionality allows having PayPal payment links only for posted documents, but they wanted to generate it in advance for non posted sales orders:

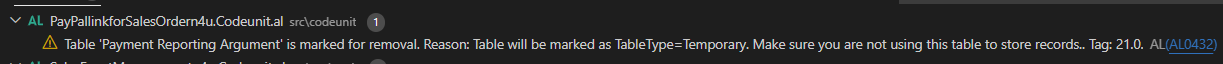

We successfully adjusted the functionality, but with Business Central 2022 release wave 2 we got a warning that one of PayPal Base Application tables (table 1062 "Payment Reporting Argument") is marked for removal:

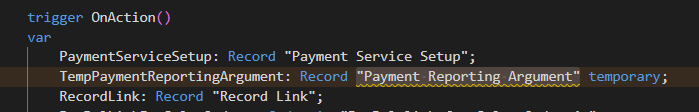

In fact, it is not a removal: TableType property of the table will just be changed to Temporary.

So, if you use this table (you'll see this warning in your code), just check this record usage. It must be declared as temporary everywhere:

This warning is a bug, as it should not be generated for temporary "Payment Reporting Argument" records, only for normal (non-temporary) records. Microsoft needs to fix it in one of upcoming minor BC releases.

Happy coding.

Any thoughts on the matter?

Related posts

Realtime Warehouse Coordination with AI Development

The Challenge: Realtime Coordination Across Two Warehouse Facilities

Our client, a rapidly expanding business, faced a critical operational challenge after adding a second facility—a large warehouse. Effective communication between the front desk team in Building 1 and the warehouse/loading team in Building 2 was essential for efficiency and safety. They required a web application to streamline this process, enabling the front desk to log customer arrivals and assign loading lanes while the warehouse team managed bay assignments and loading status. The app needed to support 10-15 simultaneous users with realtime updates, integrate with their Business Central ERP system to update sales orders, and maintain a historical log of customer activity.

SFTP usage in Dynamics 365 Business Central

Files exchange in between systems is not the best way to integrate. However, when API is unavailable or cannot be used, SFTP (SSH/Secure File Transfer Protocol) can be one of the options to consider

For Business Central on-premises you can use WinSCP dotnet libraries and successfully read/write/delete files directly on SFTP server. However, you can't use this approach for SaaS Business Central. What can be done in that case? The answers are provided in the article below.

QuickBooks vs Dynamics 365 Business Central

Learn about the advantages of switching from QuickBooks to D365 Business Central when it comes to scalability.